For the ultra-high-net-worth individual (UHNWI), the concept of a private island is more than just a real estate investment; it is the ultimate expression of control, privacy, and personal legacy. It represents a tangible escape from the complexities of the modern world—a retreat that moves beyond luxury and into the realm of the truly bespoke. However, the path to owning and maintaining a private piece of paradise is complex, requiring a clear-eyed understanding of both the immense rewards and the formidable challenges.

This article, crafted with an advisory and experienced perspective, offers a thorough examination of the private island market. We delve into the motivations behind these monumental purchases, the due diligence required, and the often-overlooked logistical and environmental hurdles, providing the necessary expertise and trustworthiness for those considering this rarefied asset class.

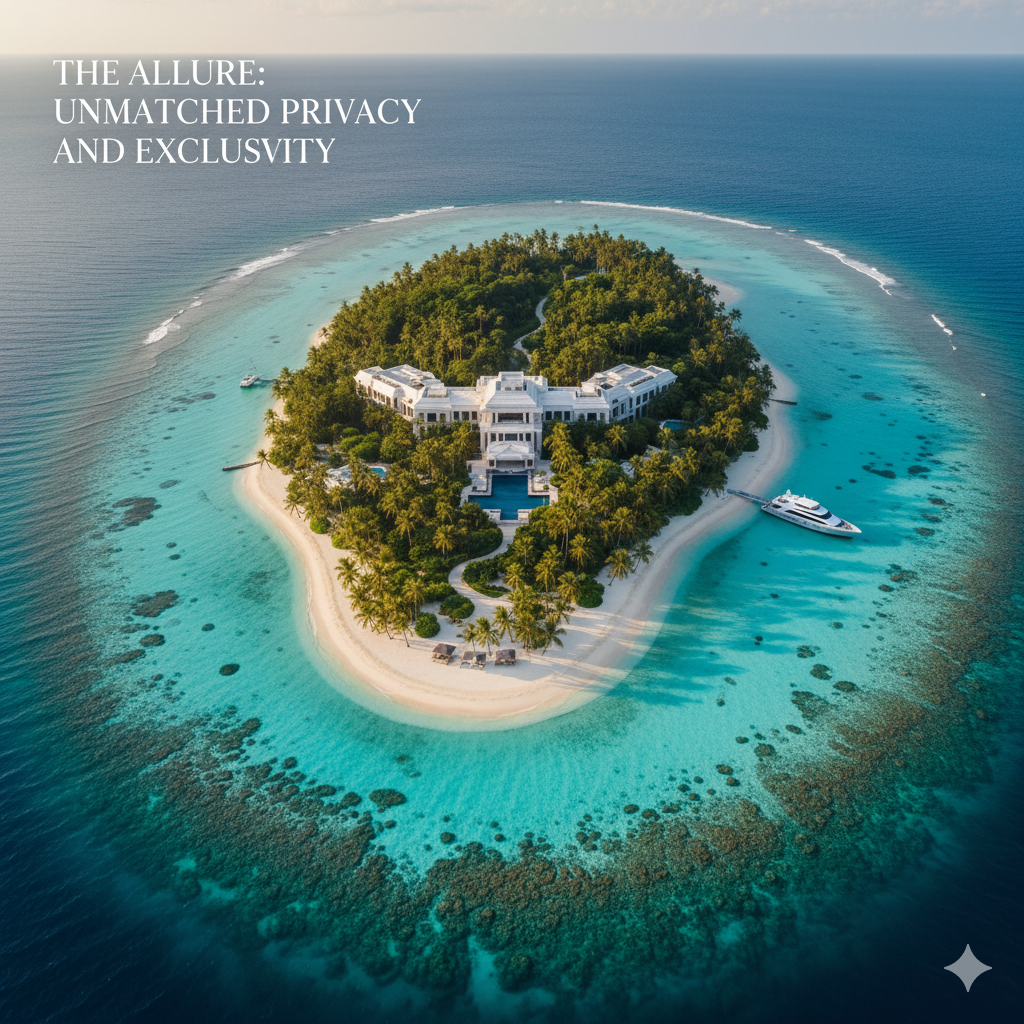

The Allure: Why Private Islands Captivate the Wealthy

Private island real estate occupies a unique position in the global market, distinct from traditional prime residential or commercial property. The decision to invest here is often driven more by emotion and lifestyle than by pure financial metrics, yet the financial returns can also be compelling.

The Unmatched Pros of Island Ownership

1. Unparalleled Privacy and Exclusivity

The primary draw for UHNWIs is the exclusivity and complete control an island offers. In an era where personal data is constantly monitored and high-profile figures face relentless scrutiny, a private island provides an unmatched sanctuary. You control the access, the surroundings, and the atmosphere. This is the ultimate privacy asset, where seclusion is guaranteed, not merely rented. Unlike a gated estate, the surrounding ocean acts as the most natural and effective security barrier.

2. The Ultimate Trophy Asset and Status Symbol

A private island is arguably the ultimate trophy asset, a statement of status that few other possessions can rival. It’s an asset that places the owner in an exclusive global club, often garnering significant prestige. This is not just wealth; it’s an assertion of dominion, a personal kingdom molded entirely to the owner’s vision.

3. Complete Design Freedom and Customization

When purchasing an undeveloped or sparsely developed island, the owner gains unparalleled freedom to customize their domain. From deciding on architectural style to implementing self-sufficient power and water systems, every aspect can be meticulously tailored. This freedom is critical, allowing for the creation of unique properties like Richard Branson’s Necker Island or Leonardo DiCaprio’s eco-conscious Blackadore Caye, which blend luxury with a profound personal or philanthropic mission.

4. Diversification and Revenue Potential

While often a purchase of passion, a private island can also serve as a valuable element of a diversified tangible asset portfolio. The scarcity of title-ready islands means they hold their value, often appreciating over time, especially those in highly desirable or politically stable regions. Furthermore, many owners transform their retreats into exclusive island resorts for part of the year, generating substantial rental income. This hospitality stream can turn a significant maintenance liability into a profitable venture, which is where market forecasting driven by AI-powered tourism analytics plays a vital role in setting rental rates and predicting occupancy.

5. Eco-Philanthropic Opportunities

For environmentally minded UHNWIs, an island provides a unique platform for conservation and sustainable development. Purchasing an island allows the owner to dedicate significant resources to preserving local marine and terrestrial ecosystems, creating a living nature reserve. This commitment to sustainability, guided by modern ecological data analysis and potentially even an AI-driven resource management system, can add long-term value and positive global recognition to the asset.

The Intricate Challenges: Logistics, Costs, and Risks

The idyllic image of island life often belies the monumental challenges that accompany ownership. Prospective buyers must move past the romance and engage with the demanding realities of remote asset management.

The Defining Cons of Island Ownership

1. Astronomical and Ongoing Operational Costs

The initial acquisition cost is only the beginning. The operational expenses of a private island are astronomically higher than any mainland property. An island is, effectively, a self-contained micro-society that requires total self-sufficiency.

- Infrastructure Essentials: An undeveloped island requires a massive upfront investment, often in the multi-million dollar range, to install basic utilities:

- Potable Water: This demands high-capacity desalination plants or advanced rainwater harvesting systems.

- Power: Reliable, continuous power necessitates renewable energy (solar/wind farms) with substantial battery banks and backup generators.

- Communication: High-speed internet and reliable phone service often require costly satellite links or undersea fiber-optic cables.

- Maintenance and Staffing: Maintenance is constant and expensive due to the harsh marine environment (salt, storms, humidity). A dedicated, skilled staff—including a manager, engineers, boat captains, chefs, and security personnel—is required year-round. This staffing budget alone can easily exceed six figures annually. Transportation costs for consolidating supplies, from fuel to fine wine, are always a substantial operational burden. A smart island owner will utilise an AI-based preventative maintenance schedule for all critical infrastructure to anticipate failures and manage costs.

2. Logistical Nightmares and Accessibility

Remoteness, while a pro for privacy, is a major con for logistics. Everything and everyone—from construction materials and specialty contractors to fresh groceries and medical professionals—must be transported.

- Transportation Dependability: Access relies on boats, helicopters, or seaplanes, all of which are expensive to purchase, maintain, and staff. Bad weather can make an island inaccessible for days, interrupting supply lines and creating emergency risks.

- Emergency Response: Proximity to a major airport or a quality mainland hospital is a critical but often overlooked factor. The 90-minute “golden hour” for medical emergencies is a serious metric that must be part of the selection criteria, as being too far from advanced care dramatically reduces the value and viability of an island. This is one area where AI-powered logistics planning can optimize delivery routes and emergency asset deployment.

3. Complex Legal and Regulatory Hurdles (Due Diligence is Paramount)

The legal landscape of island acquisition is significantly more convoluted than mainland property. A failed investment can often be traced back to inadequate due diligence.

- Title and Tenure: Buyers must be certain they are acquiring a freehold title, granting absolute ownership, rather than a less secure leasehold, which can have restrictive covenants and limited terms. An exhaustive title search covering decades is non-negotiable, particularly in international jurisdictions where land registry systems may be less robust.

- Zoning and Environmental Restrictions: Local and national governments impose strict zoning regulations and environmental protection laws. These can severely restrict the size, height, and location of development, and may ban certain activities. A comprehensive environmental impact assessment (EIA) is mandatory to identify protected species, fragile ecosystems (like coral reefs), and archaeological sites. Understanding these limits is critical before an investment is finalized.

- Tax and Corporate Structure: The purchase must be structured correctly to navigate international and local tax implications, including transfer taxes, capital gains, wealth taxes, and potential import duties for construction materials. Often, the island is held within a complex corporate structure, requiring specialist legal and chartered accounting advice in the host country.

The Evolving Risk: Climate Change and the Role of AI

A modern, high-value assessment of island real estate must confront the most significant long-term risk: climate change and sea-level rise (SLR). The valuation of a coastal asset that may face increased coastal erosion and storm severity is a challenge traditional appraisal methods can no longer handle alone.

Mitigating Climate Risk with Data

The long-term viability of a private island is intrinsically linked to its geological elevation, natural coastal defenses, and its location within major weather patterns.

1. Sea-Level Rise and Coastal Erosion

SLR is a critical vulnerability for low-lying islands, particularly those in the Caribbean and the South Pacific. Increased storm intensity and frequency exacerbate coastal erosion, which can physically shrink the island over time. Buyers must engage with specialists to conduct LIDAR surveys and bathymetry studies to fully map the island’s topography and surrounding seabed.

2. AI in Valuation and Risk Mitigation

This is where the application of AI and machine learning is rapidly becoming indispensable for trustworthy valuations. Traditional appraisals look backward; the future demands forward-looking predictive modeling:

- Predictive Modeling: Advanced AI models can ingest decades of localized sea-level data, storm surge histories, and high-resolution satellite imagery to simulate worst-case climate scenarios over a 30- to 50-year timeframe. This provides an objective, data-driven climate risk score that directly influences valuation.

- Structural Resilience Planning: The same AI can then be used to model the resilience of proposed development plans. It can optimize building placements and elevation, recommend specific types of sea walls or natural defenses (like mangrove planting), and even predict the most vulnerable points on the island’s coastline, ensuring the integrity of the investment. A smart investor leverages AI not just to buy well, but to build to last.

3. Insurance and Financial Exposure

Insurers are now using sophisticated AI to assess catastrophe risk on coastal properties, leading to massive variations in premium costs. A poorly assessed island will face prohibitive insurance costs, or even be deemed uninsurable. Buyers must ensure their chosen asset’s climate-related liabilities are manageable. Financial institutions are also beginning to use AI to factor climate risk into loan qualification for such niche real estate.

Case Studies: Learning from Success and Failure

The history of private island ownership is filled with both dazzling success stories and cautionary tales. Learning from these examples provides invaluable expertise.

Successful Investments

- Necker Island (Sir Richard Branson): Purchased for a modest sum in the 1970s, Branson developed a world-renowned luxury resort that generates significant revenue and provides a highly-publicized platform for his brand. The investment was a clear success, blending personal enjoyment with shrewd business.

- Musha Cay (David Copperfield): The magician transformed a cluster of islands in the Bahamas into an ultra-exclusive rental retreat. This is a model of successful commercialization, where the unique experience justifies a premium daily rate, generating substantial returns that offset the immense operational costs.

Cautionary Tales

- Fyre Festival Island: While not a true real estate investment in the traditional sense, the debacle highlighted the risk of over-promising and under-delivering on infrastructure and logistics in a remote setting. The complete failure to execute on basic necessities—sanitation, shelter, and security—demonstrated that romantic vision without meticulous planning results in immediate, public, and catastrophic failure.

- The Undeveloped, Remote Island Trap: Many undeveloped islands are bought cheaply but prove to be financial sinkholes. The cost of installing basic infrastructure can be 10 to 50 times the purchase price. Buyers who underestimate the need for robust utilities, failing to budget for sophisticated desalination and power systems that today are often managed by AI-driven utility platforms, find their dream quickly becomes a bankrupting nightmare.

The Final Verdict

Investing in private island real estate is the apex of luxury investment, demanding an exceptional blend of capital, due diligence, and logistical fortitude. It’s an asset that offers unparalleled lifestyle benefits and portfolio diversification, but only if the owner approaches the project with disciplined, multi-faceted planning.

The key to success lies not in the beauty of the island itself, but in the strength of the team surrounding the investment. This team must include specialists in international law, high-end remote logistics, environmental engineering, and financial structuring. For those who embrace the complexity and leverage modern data analysis—including the power of AI for risk assessment and long-term planning—the private island remains the one true asset that can genuinely deliver on the promise of owning a perfect, personalized paradise.

Moses Oyong is a luxury real estate advisor with a passion for arts and culture, music, fashion, and all things luxurious. With a keen eye for beauty and attention to detail. I strive to help my clients find their dream homes that reflect their unique sense of style and taste whilst providing them with the right information to ease the stress of the decision-making process.